Why Are Canadian Oil Stocks Up Today

The oil industry is basically dealing with a double black swan event causing catastrophic oil pricing which can severely hurt both American and Canadian oil companies if oil consumption doesnt float back up to higher levels both bringing up the demand and bringing down the oil. Oil Gas 360 co EnerCom Inc.

Why Enphase Energy Canadian Solar And Sunpower Stocks Look Shiny Today The Motley Fool In 2021 The Motley Fool Renewable Sources Of Energy Solar

The company doubled its resources and production when.

Why are canadian oil stocks up today. A new Senate proposal to legalize marijuana would let cannabis companies use banking services and trade on major stock exchanges according to a person involved in negotiations on the legislation a potentially dramatic breakthrough for an industry long stymied by federal restrictions. Another factor helping boost Canadian oil stocks is that more companies are cutting their capital spending plans and production guidance which will help ease the near-term glut of oil in the. COVID-19 wreaked havoc on all Canadian energy companies as the demand for oil plummeted and cash flow was severely impacted.

There are three key reasons behind the drop into negative territory. Or call 303-296-8834. Canadian oil stocks appear cheap today.

Oil production fell 10 year over year primarily because of the decision to shutter uneconomic wells and slash capital spending. ET Tuesday-Friday at 11 am. Commodities Monday at 1130 am.

CVX announced a 20 cut in its FY 2020 guidance for organic capital and exploratory spending of 20B to 16B as well as suspension of its 4B stock. Canadian Natural Resources CNQTO is an oil and gas exploration and production company. From aluminum to zinc and everything in between join BNN Bloombergs Andrew Bell for the latest insight into the hot world of commodities and the companies that produce them including interviews with mineral and mining entrepreneurs from Canada and around the globe.

Thats because the Resource sector including oil is highly volatile and no one can accurately predict future oil. But their prices have gradually been climbing and 2021 looks to offer a more prosperous outlook for the sector. Canadian oil and gas stocks whether it be Canadian pipeline companies oil producers or natural gas producers are faced with economic conditions that have simply never been seen before.

But other factors could also buoy oil stocks. In just over a week Canadians will find out whether they can expect a pro-oil administration south of the border. At TSI Network we continue to advise against overindulging in Canadian oil stocks.

Canadian oil stocks are stock issues for companies that explore for produce and refine oil. Oil and gas production from Indias northwestern state of Rajasthanhome to the countrys single biggest oil and gas deposithas slumped by 40 percent over the past two years mostly due. It produces synthetic crude.

An improvement in Canadian oil prices would also help smaller producers like Baytex Energy and Crescent Point Energy which need higher oil prices to support their operations. 1-Year Trailing Total Return. The novel coronavirus pandemic has sapped global energy requirements global oil.

Oil output may increase by early 2022 if inventory drawdowns persist says ANZ Thu Aug 12th 2021 Barclays picks the global stocks to buy in the cheapest sectors. Many people see the death of oil as a welcome solution to combating climate change. Why Canadian Oil Stocks Are Soaring Today The government of Alberta is taking extraordinary measures to boost regional oil prices.

When the pandemic hit last year it destroyed oil and gas stocks. E-mail for Advertising Information. These companies are typically headquartered in Canada but can also explore for produce and refine oil in other countries too.

Cenovus for example trades at just 12 per share at writing compared to more than 30 five years ago. Oil prices could rise on demand. An improvement in Canadian oil prices would also help smaller producers like Baytex Energy and Crescent Point Energy which need higher oil prices to support their operations.

But this is not a realistic view. We are hugely reliant on oil. What are Canadian oil stocks.

Western Canada Oil Prices Remain Strong As Alberta Cutbacks Kick In Ctv News

Reuters Oil Sands Best Investment Apps Stock Market Data

Usdcad Intraday Forecast Forex Forecast City Forecast Forex Weekly Forecast

The Future Of Canada S Oil Sands Earth Org Past Present Future

Oil Just Isn T That Important To Petrocurrencies Right Now Crude Oils Currency

Today S Mcx Commodity Market Updates Commoditytips Intradaycalls Sharemarketips Beststockadvisory India Marketing Commodity Market Intraday Trading

Eia Forecasts Lower Oil Prices Higher Inventories In 2016 Oil And Gas Gas Industry Oils

The Canadian Dollar Depreciated On Wednesday After Conflicting Comments Out Of Vienna Ahead Of The Meeting Between Org Finance Blog Business Confidence Gbp Usd

Direct Participation Oil Investments Investing Infographic Oils

01 25 2016 North American Stock Markets Renew Plummet As Oil Rally Fizzles Canadian Stock Prices Are Sli Stock Market American Stock Toronto Stock Exchange

U S Election And Oil And Gas Sector Ctv News

Oil Pipelines Oil Sands Magazine

Oil Rally Is This The Real Deal Or Is A New Bottom On The Way Crude Oil Oils Crude

Map Of Canadian And U S Pipelines And Refineries Gas Pipeline Oil And Gas Crude Oil

World S Oil Producers Prepare For A New Era Of Low Prices World Oil Brent Crude Oil Crude Oil

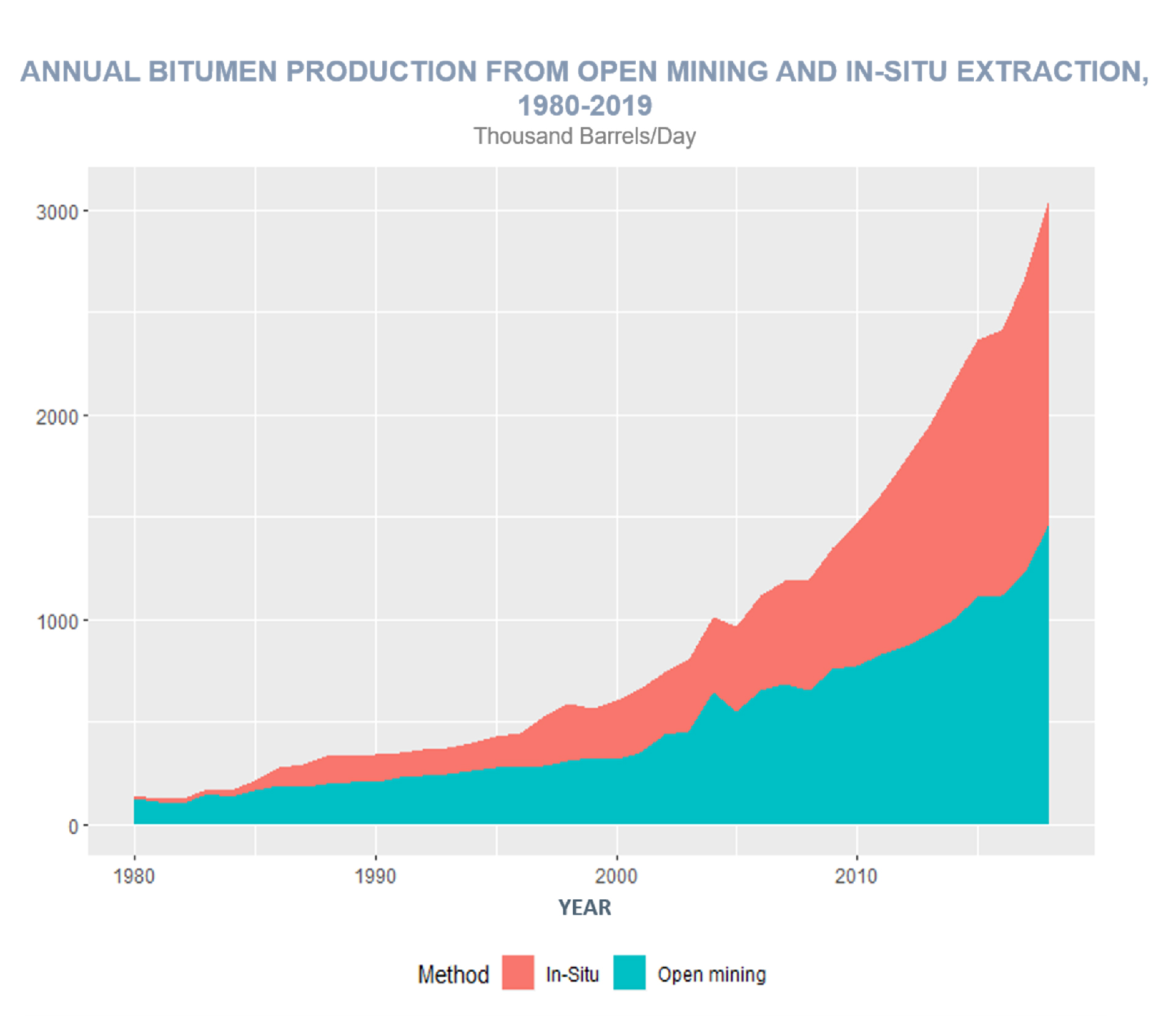

Crude Oil Forecast Canadian Association Of Petroleum Producers

Posting Komentar untuk "Why Are Canadian Oil Stocks Up Today"